Great healthcare benefits you can actually afford to use

An innovative health plan that helps provide high-quality care and lower costs by working directly with local healthcare providers.

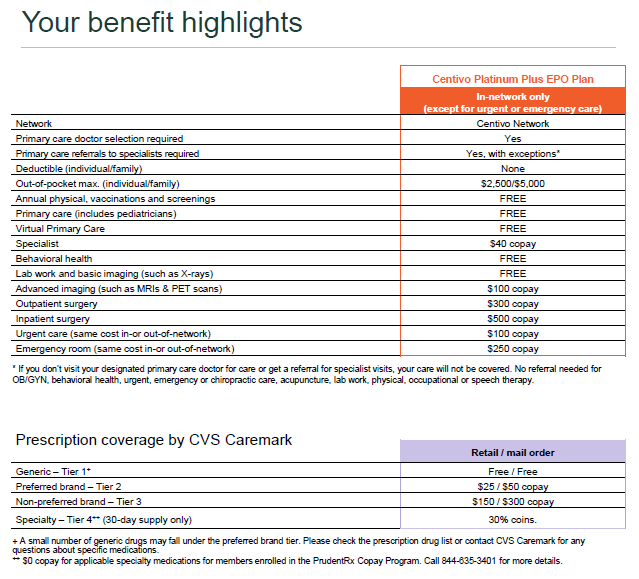

Centivo Platinum Plus EPO Plan

No upfront costs

The plan has no deductible. That means it pays right away – there are no upfront costs you must pay before your benefits kick in.

FREE doctor visits

FREE visits with your personally selected primary care doctor, including pediatricians. See them as often as needed to stay as healthy as possible.

Know what you owe before you go

Set copays mean you’ll know what you owe – if anything – before you go to the doctor, with no surprise bills.

Right care, right time

Your primary care doctor will refer you to in-network specialists for high-quality care to meet your needs.

High-quality healthcare providers

Access to a tailored network of local, virtual and national healthcare providers for quality care when and where you need it.

Medical coverage when traveling

Urgent and emergency care is covered as in-network when you’re away from home.

Is the Centivo Platinum Plus EPO Plan right for you?

If any of these apply to you, you should consider one of Centivo’s plans.

- I want to save $ on my healthcare.

- I see doctors in the Centivo Network and want to continue to see them.

- I’m willing to change doctors to an in-network provider.

- I don’t have a primary care doctor today.

- I visit urgent care or the emergency room whenever I need care.

- I want to know what I owe – if anything – before I go to the doctor.

how it works

Take these 3 steps to get the most from your plan

Step 1: Pick a Doctor

- Choose a primary care doctor, a step Centivo calls activation.

- If this is a new doctor, schedule an appointment, so they can get to know you and your healthcare needs.

- If you activated last year, you don’t need to activate again.

Step 2: See your doctor first for any healthcare needs

- Your doctor can help you stay as healthy as possible.

- When you get sick, your doctor can identify the issue and start treatment.

- If you have ongoing conditions, your doctor can help you manage them and make medication adjustments.

Step 3: Get referrals for specialty care

- Get a referral from your primary care doctor when you need specialist care.

- They’ll send the referral to Centivo for you, and it will be good for one year.

- All you need to do is make sure you see the referral in your Centivo app prior to seeing the specialist.

A health plan you can actually afford to use.

Industry average

Industry average* annual out-of-pocket costs for traditional health plans.

Centivo average

Average annual out-of-pocket costs for a Centivo member.**

Savings with Centivo

Centivo member average annual out-of-pocket savings.

**Based on Centivo 2022 book of business data.

Understanding key insurance terms

The amount you pay out-of-pocket before the plan pays towards your healthcare costs. There is no deductible with the Centivo Platinum Plus EPO Plan.

A fixed dollar amount you pay for a healthcare service or visit.

The percentage of costs you’re responsible for after you meet your deductible. If coinsurance is 20%, you’ll owe 20% of the cost after you reach your deductible. There is no coinsurance with the Centivo Platinum Plus EPO Plan.

The most you’ll pay for any covered healthcare expenses during the plan year.